We have come upon the second anniversary of a week of trading I will never forget. Two years ago, shortly after I had started managing an account for an executive at our company we found ourselves in this predicament:

For the two quarters leading up into August, I was having my way with the market, gaming sector rotation like a champ and outperforming handsomely using directional option bets (Gasp) to increase leverage. As is often the case throughout the spring and summer months, we had been in a period of low volatility with low market speed, decreased market volatility and low correlation among U.S. equities. A perfect environment for stock picking.

What you don’t want to see when you are fully loaded with long directional option bets in risk assets is the following:

The VIX “Fear Gauge” had spiked from the mid teens to near 50. ATR levels followed suit signaling a drastic increase in market speed followed by a major uptick in correlation among stocks. What this means is essentially that it doesn’t matter which stocks you own, they all trade together, and trade lower.

And Omahacharts gets deballed as he was naive to the concept of correlation and speed.

In the days to follow there was chatter all over Financial Twitter about an impending stock market crash. The headlines were pessimistic and market participants were fleeing stocks for safety. CNBC probably ran a Markets In Turmoil Special.

That is when I knew things were getting…better. Markets do not top on pessimism. When the herd is fraught with emotion and busy calling market tops you can almost always be sure a bounce is right around the corner. I spent time screen capturing examples of market pessimism from some of the Twitter influential along with headlines from the major financial news outlets. It was amazing to see how fast the mood changed, and that became a signal.

Further to the dark mood hanging over market sentiment, we saw risk instruments like the $FDN ETF which tracks internet stocks bounce quickly, and the Russell Index one of the best risk gauges left a long lower shadow, signaling bulls defending lower prices.

As frightening as it was to experience at the time, was August 2015 a market top? No. It was a blip in the course of a longer term uptrend. One of two major opportunities at the end of 2015-beginning of 2016 to put capital to work. To be fair, I did a lot more analysis at that time to conclude we weren’t anywhere near a market top but I think it can all be summed up by the following:

“If you think we are near a market top, we aren’t.”

Markets don’t work that way. Fear mongering sells ads and gets you to click on headlines but that’s about it. Hindenburg Omens, Death Crosses, Economic Indicators signaling a slow down in home sales, and Market’s In Turmoil Specials should be taken as a grain of salt.. or as a signal you would be prudent to get long. Tops are processes, not events and markets in the age of high speed computers have evolved into pain mechanisms. An old pit trader used to say markets are like a big whore, out to fu*k as many people as they can. I tend to agree.

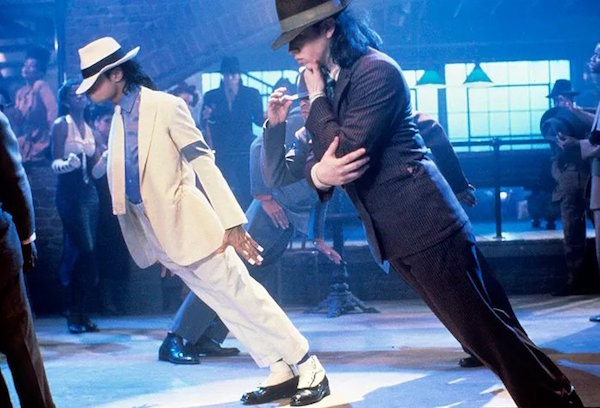

One of my favorite clips about the market (and life) is below. Give it a listen.

THE WHAT IF’S