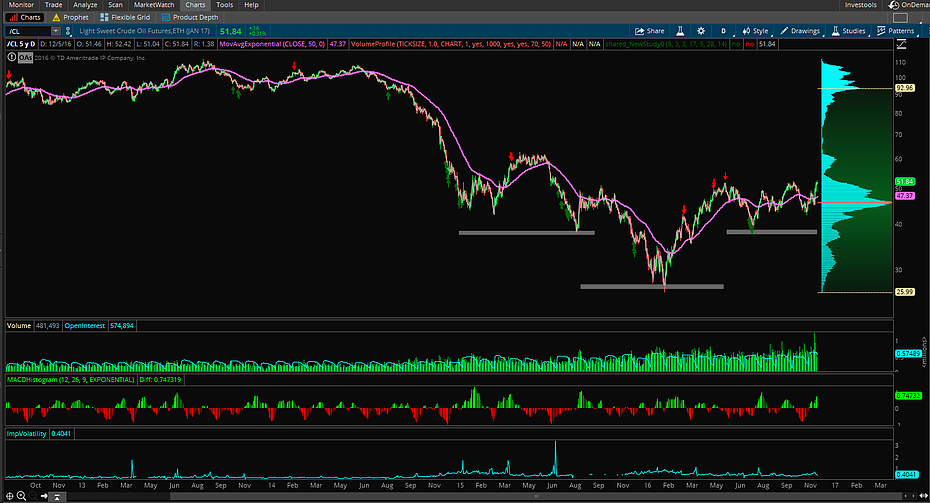

I would argue that Crude Oil is one of the most watched financial markets, period. Whether you are a commodity speculator, fuel buyer, risk manager of a commodity fund or even an equity trader, a chart of the Crude Futures is somewhere on your screen. Its impact on the Global Markets is undeniable. Over the course of the past couple of years, /CL has nearly completed an Inverse Head and Shoulders Bottom, or Reverse Head and Shoulders Pattern if you prefer. Technically this pattern would constitute a complex H&S Bottom but for simplicity we will keep it simple. Here is what you are looking for with these patterns:

A. A downtrend leading into the pattern. Check.

B. Formation of a left shoulder. Check.

C. Formation of a head which is below the left (and right) shoulder. Check.

D. Formation of a right shoulder. Working on it and I would say Check.

E. To confirm the validity of this pattern we need to see a break above the neckline which I would argue would be complete with a close above $54 (the neckline) as long as it remains there.

We are close, as you can see by this chart:

What’s more, the Volume Profile with the exception of a little resistance near $60, is wide open overhead to about $90.

It may be a bit easier to see the neckline in this chart:

We are awaiting on confirmation of an upward breakout and close above that neckline. If we get that? A move to $70-75 real quick could easily be in the cards. This is the $25 move from the head to the neckline added to the neckline breakout as well as the 161.8% Fibonacci Extension of the move from $27 to $51 where we sit today.

So what’s the call? If we break the neckline just above, I see oil at $70 to $75. By when? March isn’t out of the question. If we don’t break the neckline a retest of $45 is probable.

Should oil rally to the $70-75 level (and beyond) things could get interesting for the equity markets. Significant oil rallies are known to precede recessions.

Keep a close eye on oil and let’s see what happens.

@omahacharts

Make sure to get in touch also if you guys have any questions. trent@omahacharts or: https://omahacharts.com/contact

I am always happy to hear your ideas and input!