Over the weekend I began a lengthy blog highlighting a completely unbiased look at financial markets. Before this is released I wanted to see what the first day of the month had in store for us. It’s no secret that May was not kind to investors and there don’t seem to be blue skies ahead just yet. That being said, one thing that always surprises me when we get these market pullbacks is the unwillingness to invest. In anything.

In my lifetime alone there have been a half a dozen “crises” that were just sure to topple markets, never to come back again.

And what happened? They came back. Every single time. Of course this time could be different. The global economic slowdown could send markets to 0 never to rebound. The tariffs imposed on multiple counties could be the start of another Great Depression where I am forced to siphon gas out of cars parked at the mall and steal flour from my neighbor’s house. Or, the pullback in May could be another run of the mill market correction that is a buying opportunity for a beaten down stock or two if your timeframe is longer than 2 weeks.

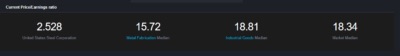

I stepped in and bought US Steel on Friday. I believe it is just a bit too overdone here. I’ve never been called a value investor but maybe I will turn over a new leaf. Take a peek:

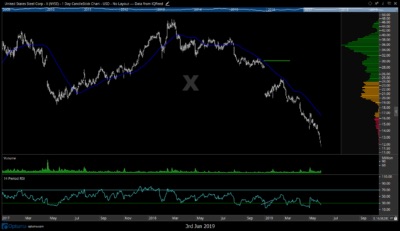

And from a price action perspective:

Daily price action beginning in 2017 shows X Stock in that 3rd standard deviation zone, ripe for mean reversion.

I know it’s scary. I know the headlines are bleak and keep getting worse. I know I know I know. But as my neighbor down the street says, “Buy When Others Are Fearful.”

And you guys are scared as shit right now.

Good Day.

Trent J. Smalley, CMT