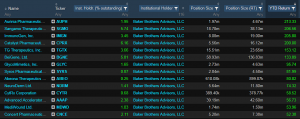

Some years ago, I was introduced to the Baker Brothers Advisors, LLC and their impressive track record investing in the life sciences vertical. Now in their mid to late 40s, Felix and Julian Baker have grown their fund over a 17 year period. Founded in the year 2000, some of the earliest filings show the fund began with about 250 million under management – relatively small. As of March 31st, 2017 over 11 billion has been under management. The latest filing along with a comprehensive list of their positions can be seen at the link just below:

BAKER BROTHERS ADVISORS INSTITUTIONAL PORTFOLIO

As you can see, 4 names over 200% and several others also have shown to be impressive wins so far.

For those of you not up on how these stocks work, proceed with caution. They can juice your portfolio or trading account and send you parading down the canyon of heroes, or leave you in a sundry of hazardous financial predicaments. Put them on a watch list for a couple weeks and pay attention to their personalities, as they are known to exhibit many of the disorders you learned about in your abnormal psychology courses.