The title alone will ensure a spike in readership. Fear, uncertainty, and doubt garner clicks especially when it comes to the financial markets. Higher clicks is not my goal however, and never has been. Long time followers of this blog know I always speak rationally, and from a glass half full perspective. So why such an ominous title?

A friend of mine (and client of JSPM LLC) asked me to listen to a radio show this past weekend where a financial advisor was a guest. The advisor and radio show will remain nameless because it doesn’t matter, but the tone and scare tactics used were borderline perverse. Mr. Advisor urged that he had purveyed the landscape and “in all his years in the investment business had never been more sure of impending doom for financial markets.” Troubles with China, stock market valuations, inflation (OH THE INFLATION), the endless money printing by central banks worldwide, solar flares, and vampire bats (probably) will bring this whole house of cards to its knees. He had good news however… For the final 20 minutes of his hour long show, the phone lines were open and he had staff standing by to take your call so that you had a chance to sidestep the oncoming major market meltdown. He and his staff posessed the antedote to remedy your investments which would soon be poisoned.

Back when this blog (and I) had to be much less professional and regulators didn’t scrutinize me, I would have called into this radio show and annhiliated the guy on air. I then would have posted the audio clip here so you could get a good laugh. We’re all grown up now, and those days are behind us. So what I will offer up is some suggestions and data for those who live in a constant state of worry when it comes to investing.

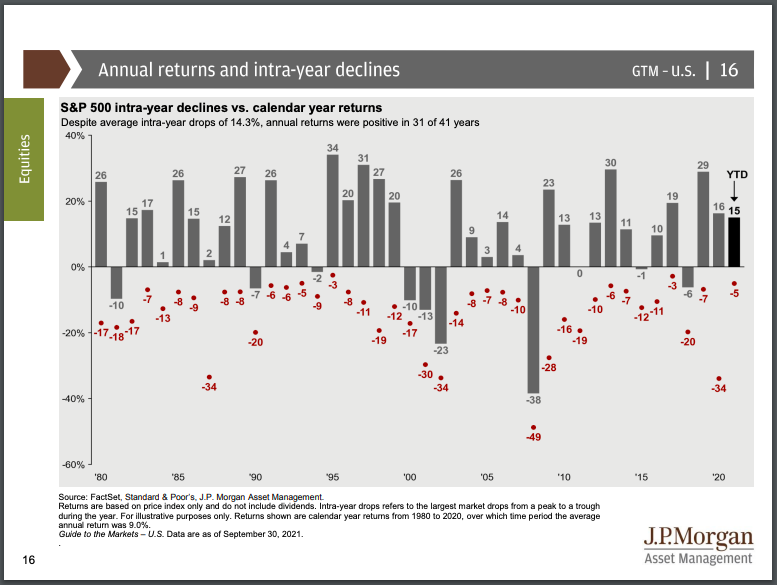

Let’s assume you are of working age (not yet retired) and have the majority of your funds in the S&P 500 Index. The very same index that Mr. Advisor said was in for a sharp correction. Data says differently, if you bother to look:

Thirty one out of 41 years you made money, and the positive years on average far outpace the negative years. As a reminder, we kind of got a “market crash” just last year. They aren’t very common.

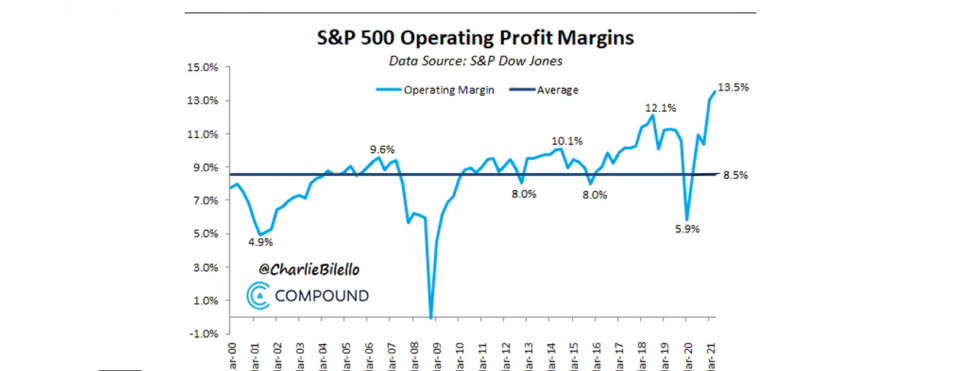

Mr. Advisor went on to mention that he currently sees an “everything bubble.” Stocks, real estate, prices of used cars, commodities, etc. all were elevated to unwarranted levels. A blatantly obvious oncoming recession is just around the corner and stocks as an asset class would likely take the brunt of the hit. An important measure of stock market performance, and liklihood of a recession can generally be explained by operating profit margins. You want profit margins higher, as these signify overall health of a company. Taking that dreaded S&P 500 index which is surely doomed, here is a look at a composite operating profit margin:

That doesn’t look like much of a recession… He must have forgotten to look at those too.

So what posesses someone to go onto a morning radio talk show, and urge listeners to “act now before it’s too late” when it comes to their investments? Money of course. It could be that Mr. Advisor is full aware of how scare tactics get listeners to react. He stands to gain a client or two when uninitiated and unaware ears happen upon his Saturday morning rousings. He probably has had success doing this in the past, and to each their own when it comes to gaining new clients. But this has not and never will be my firm’s method of attracting capital.

So what do I think about the current state of the market? A more in depth post on this will soon follow, but for now here are a few observations as they relate to where we are, and where we are likely to go…

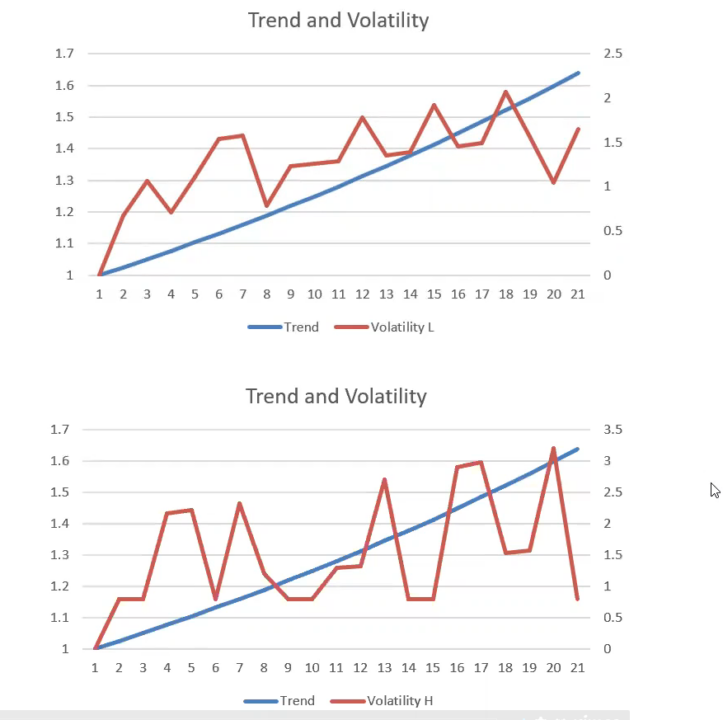

Ophir Gottlieb of Capital Market Laboratories shared this image which perfectly illustrates markets currently. The same equity curve trend with more volatility. If you find yourself watching day to day price action, you’ll notice. If you look quarterly, semi annually, etc. the overall market is doing fine and likely will continue to do so.

Before I wrap this up, it’s also important to note that at JSPM LLC, we take an active management approach. This means we are not “set it and let it advisors” who stay the course no matter what. We guard against the downside, and take advantage of trends across multiple asset classes. Those invested with us will never have to worry about losing a large portion of their investible assets. We don’t allow that to happen, so should a significant drawdown occur (and someday it will), our clients will be spared to a greater degree than a set it and let it investment approach. Long term outperformance often comes from playing good defense when warranted. Afterall, half of this job is managing risk and we take that part very seriously.

Back with more real soon.

Trent J. Smalley, CMT Portfolio Manager JSPM

Visit our websites: (MyPortfolioFix)

Please remember that past performance may not be indicative of future results. Different types of

investments involve varying degrees of risk, and there can be no assurance that the future performance

of any specific investment, investment strategy, or product made reference to directly or indirectly in this

newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s),

or be suitable for your portfolio. Due to various factors, including changing market conditions, the content

may no longer be reflective of current opinions or positions. Moreover, you should not assume that any

discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute

for, personalized investment advice from JSPM LLC. To the extent that a reader has any

questions regarding the applicability of any specific issue discussed above to his/her individual situation,

he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current

written disclosure statement discussing our advisory services and fees is available for review upon review.