The last week of July marks the start of earnings season for many growth stocks. Soon we will hear from companies like Apple, Microsoft, Google, and Amazon. From a long term investment standpoint, one quarter is relatively insignificant. It does however give us a glimspe into the overall growth trajectory of the companies whose shares we hold. Some of the metrics we pay attention to are as follows:

Sales and EPS Growth quarter over quarter and year over year.

Gross margins and profits.

Expanding institutional and management ownership.

And of course, price.

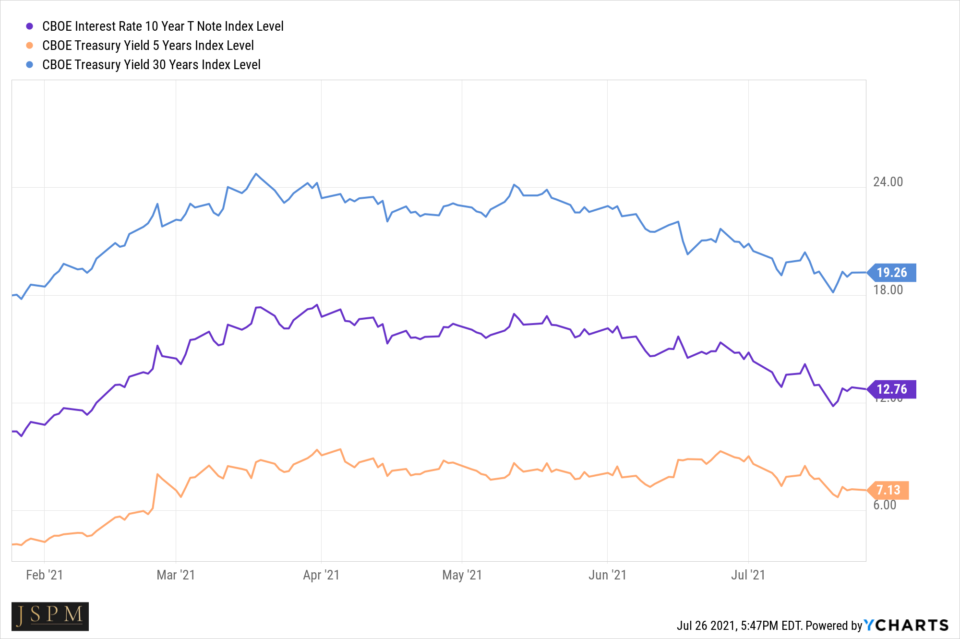

You may remember (not so fondly) this spring’s earnings season. Several months ago, many of our holdings reported stellar earnings. Those reports were met with near unabated selling. If you will remember, Q2 earnings were taking place with a backdrop of inflation fear. This can be illustrated with the graphic below showing rising 5,10, and 30 year interest rate yields:

You will notice also that just as earnings season wrapped, yields began to fall, sparking a relief rally in many of the growth names. The 10 year treasury yield has fallen from above 1.7% to levels we haven’t seen since early February. While this has been positive for growth stocks overall, it’s important to remember that “growth stocks” should not all be lumped into the same category. We hold invidual companies, and care more about individual company performance, than an overall market theme. The best of the best will separate themselves from the pack, and serve to remind us why we are on the continuous search for the best investible assets. The best investments take time to pan out, and immediate price reactions post earnings often mislead investors and cause them to sell the best merchandise at inopportune prices. Let’s take a couple of examples…

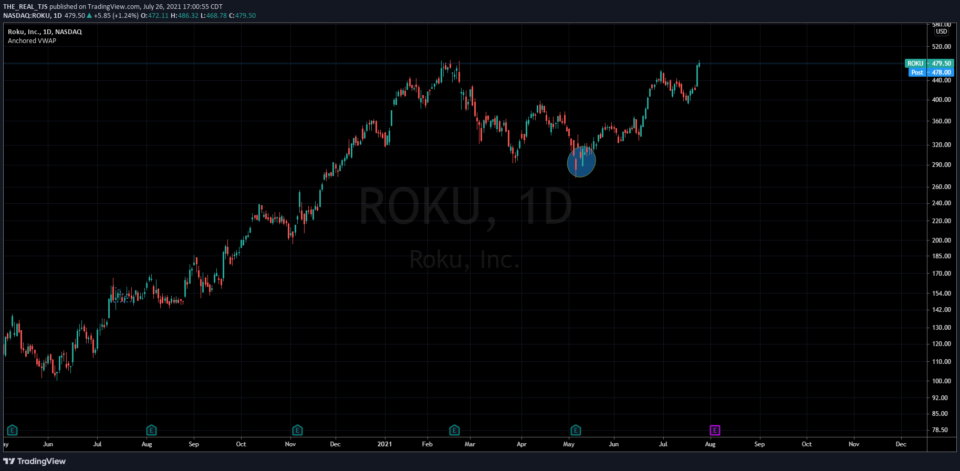

ROKU reported stellar earnings on May 6th. The stock dropped from $300 to $270. The pain was short lived. Did you sell? I hope not. It made new all time highs today.

Crowdstrike reported earnings on June 3rd (and dropped). Did you sell? I hope not, it made new all time highs on Friday.

Nvidia reported earnings on May 26th, and closed lower, just as it did the following day. Did you sell? I hope not. I really, really hope not.

Nearly every stock in my coverage is higher today than it was post earnings. We didn’t sell, and we hope you didn’t either.

This brings me to an important point. There is a tennant among financial pros that says “price is truth.” In other words, the market is never wrong. Here is a secret: It’s wrong all the time, especially when you have a longer term view. Was price truth when ROKU was sold off 200 points ago? Price is mistruth. It’s the most untruthful post news events and earnings reports. And if you don’t know what to look for, and don’t understand the individual companies and their growth trajectory (yes fundamentals), you’ll chase your tail in and out and back in. I did that for a long time, and it leads to headaches and missed opportunity.

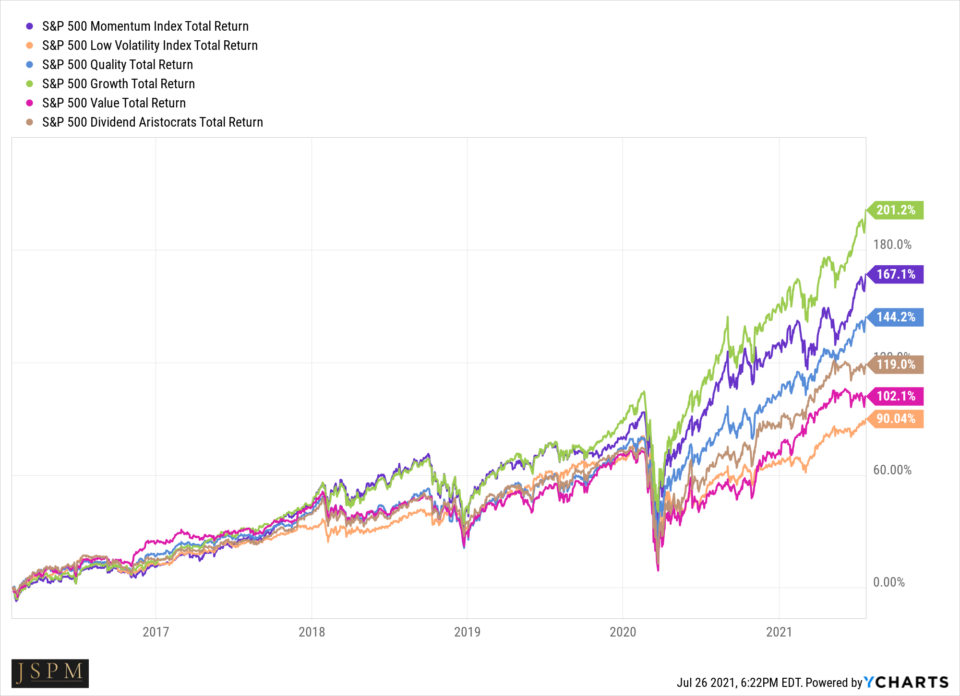

A final reminder of the “why” we invest in high growth stocks:

The green line is the why. A well known analyst put it to me this way: “Buy the best, hold the best, make the most.” It’s a bumpy ride at times, maybe even most of the time. Investing this way can and will lead to the following questions:

Should I just put my money in an index fund and forget it?

Why didn’t I sell when ROKU was $400?

Why didn’t you beat the S&P Index this quarter?

Answer key:

If you want to just index and forget about it, go right on ahead. But I have the statistics and data to back my approach.

You didn’t sell ROKU because that would have been stupid.

No one beats the index every quarter, but I do pretty often. And this strategy has proved to be the most profitable over the long term, provided you have the perspective to stay the course.

Good luck this season, and we’ll talk soon.

Trent J. Smalley, CMT Portfolio Manager JSPM LLC

Visit our websites: (MyPortfolioFix)

Please remember that past performance may not be indicative of future results. Different types of

investments involve varying degrees of risk, and there can be no assurance that the future performance

of any specific investment, investment strategy, or product made reference to directly or indirectly in this

newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s),

or be suitable for your portfolio. Due to various factors, including changing market conditions, the content

may no longer be reflective of current opinions or positions. Moreover, you should not assume that any

discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute

for, personalized investment advice from JSPM LLC. To the extent that a reader has any

questions regarding the applicability of any specific issue discussed above to his/her individual situation,

he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current

written disclosure statement discussing our advisory services and fees is available for review upon review.