In the past, whenever a REIT (Real Estate Investment Trust) was mentioned I tuned out due to lack of interest or general misunderstanding of how they worked. But in a time when the market has been at the mercy of a U.S.-China trade dispute, REITs can serve as a safe haven investment. REITs, or real estate investment trusts, are companies that own or finance income-producing real estate in a range of property sectors. They are easily available to average investors via REIT stocks, mutual funds and ETFs, and offer exposure to businesses geared toward the domestic market.

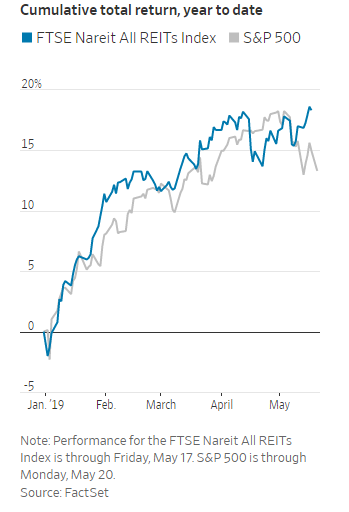

This morning, the Wall Street Journal ran an article showing the YTD cumulative return of the FTSE Nareit All REIT Index as compared with the S&P 500. The two indexes were highly correlated all year up until a couple of weeks ago when the S&P 500 began to pull back as trade war tensions escalated. You can see this from the following chart:

The FTSE Nareit All Equity REITs index has a total return of 18.32% compared with a 14.98% return for the S&P 500 year to date through Friday. By nature, real-estate stocks are particularly sensitive to rising interest rates because they use high levels of debt. Thus in rising interest rate environments REITS can struggle and often underperform other asset classes like commodities on average. However, the Federal Reserve has indicated that rates should remain low providing for an environment that should allow REITs to continue to perform well.

Investopedia published this list of the top 5 Real-Estate ETFs which is a great place to start.

With the likelihood that interest rates remain low, adding exposure to REITs to your portfolio should result in positive alpha for the foreseeable future. I am looking to add exposure myself via one of the indexes above this week.

Back with more soon.

Trent J Smalley, CMT