The investing game offers up no shortage of teachable moments. It is my job as an advisor to invest client money in such a way that fits their goals and objectives, as well as provide some insight to help them understand what they may come to expect from their portfolios. The past year has been chock-full of teachable moments, the most recent of which deserves some considerable attention.

For the general investor, the recent market moves likely seem nothing too out of the ordinary. As I write, the S&P Index is up around 3% YTD, and your average 401k allocated heavily to equity index funds would seem in line with what one would expect up to this point in the year. For growth investors however, the last two weeks were somewhat extraordinary, and not the kind of extraordinary you’ve come to expect over the past year.

Cutting to the chase, the past few weeks have been dreadful. You might have noticed a fair amount of unrealized gains disappear from your account. It’s uncomfortable, it’s maddening, it’s enough to make you question this style of investing…

It’s also absolutely normal. It’s always been this way, and it will likely always continue to be this way.

If you’ve been following along, you have heard the repeated narratives over and over:

“Covid” stocks are being left for dead as we face a reopening economy.

With interest rates on the move higher, the reflation trade is set to take tech stocks much lower.

The great rotation out of tech and into cyclical stocks or “value” stocks has begun and is going to continue for the foreseeable future.

“High multiple stocks” just don’t perform in rising rate environments.

And on and on and on.

Without a doubt, last year’s market darlings which could do no wrong, have been sold down sharply in the past month. Let’s take a look at one of the quintessential growth stocks, Tesla.

Steep rise, steep fall. Nobody complains on the way up. In fact, they come to expect it. Day after day, uninterrupted uptrend. And then… A move from $900 per share to nearly cut in half in short order. Uncomfortable, maddening, painful.

Yet 100% completely normal. It’s happened multiple times in the fairly short history of Tesla as a public company, and it will happen again. And then it will happen again.

Let’s contrast this with another type of stock from what is considered at this stage in the market cycle to be deep value, Chevron:

Down, more down, a lot of down, reversion to the mean, back down, and a nice run in 2021. A much more comfortable ride than Tesla over the past couple weeks, that’s for sure. You’d rather have been in Chevron over Tesla the past couple weeks, that’s also for sure. But what about over the last year? The last two years? Are you willing to sell Tesla right here and now and bank on an oil stock outperforming it the rest of this year? Or do you want to just be in the best performing stock every single day and never have to endure any downside?

Me too, but it’s not realistic for long term investors. If you want to day trade, that is something different entirely. And when you short term trade, if lucky enough to always be in the winning stocks, you’ll complain about the short term taxable gains when those come. Pick your poison.

An old mentor taught me once that in investing and trading all roads lead to pissed. If you make money you are pissed you didn’t make more. If you lose money you are pissed about losses, and when the tax man comes you are pissed at him. So assuming you have to choose a investing style, and you want to try and “beat the market” or you expect your advisor to do so, you have to be prepared to go through periods of that uncomfortable, maddening drawdown that comes with every style. You have to be prepared to be pissed. There isn’t a style that will outperform without uncomfortable periods. It’s nonexistent. I’ve looked for one for 15 years.

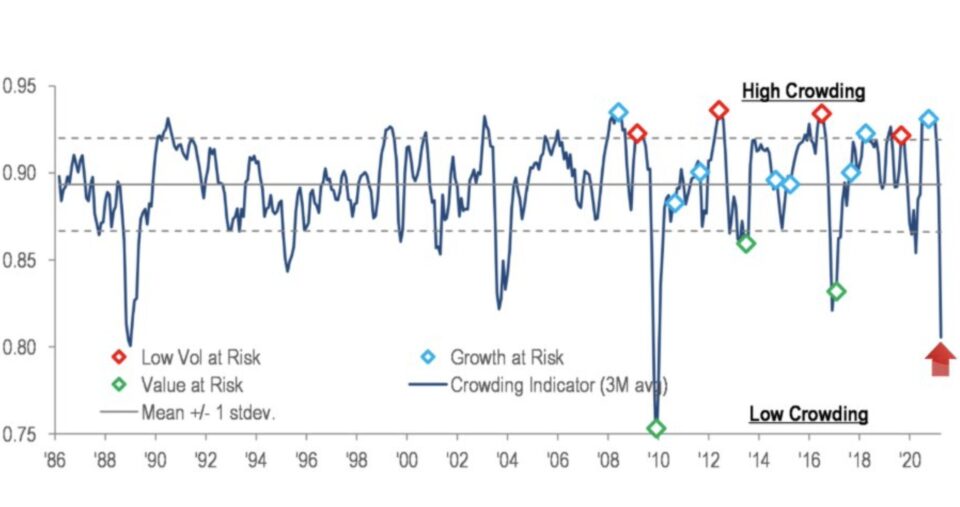

All that being said, what can we expect from this so called style of growth investing going forward? This chart that just came out this week from JP Morgan offers up a look at what has recently happened to growth stocks and what might be expected in the coming months:

Don’t read charts well? Allow me. Until about 4 weeks ago, growth stocks were highly crowded trades. Meaning, those who sought to outperform were loaded in them. Throw away the narratives run all day by financial media.

“Reopening stocks, rates rising, tech is dead, buy Cheesecake Factory, and Dillard’s which you haven’t seen a customer in for a year and sell your ROKU stock because people don’t care about advertising and there isn’t a massive trend overall in the masses cutting cable and moving to streaming television. Everyone now goes to Dillard’s and then heads to Cheesecake factory after never using technology which is now a thing of the past as the economy reopens. Or… and much more likely, what happened was a crowded trade saw a lot of investors try to exit the building all at one time. Selling begets selling, and the above chart shows that investors overshoot both through the top and bottom thresholds. “Growth” as we sit today is more oversold than it has been since 2010.

You’ve sat through some pain. You’re maddened and flustered and have thought about throwing away this style of investing which was so good to you over the past year. Your account could likely fall another 25% and you’d still be ahead of your value investor counterparts.

I’ll offer up one more chart before I wrap this up. I understand that these days it’s nearly inconceivable to look out over any considerable period of time. After all, the very devices that are considered down and out and uninvestable you find yourself checking 44 times a day to see if your stocks are outperforming, are right there in your pocket. But if you can take a step back, you’ll notice a trend that has persisted in both falling and rising rate environments alike. Though up and down markets, through normal environments and pandemic-ridden environments. This trend is growth vs. value over the long term: (Red = Growth, Blue = Value)

Good day.

Trent J. Smalley, CMT