With every new endeavor, lessons are learned. While sometimes painful in the short term, they serve to lay the foundation of forthcoming success which could only happen had these obstacles not occured. I’ve been an advisor and portfolio manager with Ryan Morse, CMT, CFP for just over a year now. In my time professionally managing money for others, I wanted to share a few lessons that I’ve learned as I’ve navigated a fairly difficult environment over the past year and a half. These lessons are ones which you won’t be taught in any financial designation, business degree program, or from any finance book. I hope that they can someday be of use to someone who is considering getting into the money management business whether that be the hedge fund space, RIA world, or something similiar.

Before detailing a few of these lessons, a brief discussion is warrated about what we consider the JSPM Way. This can best be described by listing who we are not, and what we don’t do…

We are not typical “advisors.” While Ryan completed his CFP designation and we do wholistic family planning, we aren’t typical advisors in any sense of the word. We don’t spend time at networking dinners, or holding meetings in the back room of swanky steakhouses in attempt to pitch you life insurance or annuities. We aren’t licensed to sell either, and never will be. In fact, we don’t “sell” anything.

We aren’t salespeople. We don’t cold call, do midday happy hours in suits, or throw your money in a mutual fund and go golfing. The majority of this industry is a cross between glorified sales people, and phone jockeys, neither of which are we. Truth be told I’m a horrible sales person, and want little to no attention or accolade. When I do well for clients, they let me know and I feel awkward when they sing my praises. My four suits in my closet are dusty, and I don’t care if I ever put one on again. That shoulder rubbing lifestyle is one I don’t want any part of. In short, this industry as many know it to be, probably isn’t for me at all.

So who are we? If we aren’t salespeople in suits taking client dollars and loading them up into mutual funds, what is it that we occupy our time with all day? A portion of the day is spent researching. I am at my desk two hours before the open. In that time I’m going over any news likely to affect any of our current holdings, or potential future holdings. Over the past three years, I’ve done much more fundamental analysis of individual companies, thematic trends, and any other form of analysis to give us an edge. I study market and business cycles, have a fairly comprehensive understanding of MMT – Modern Monetary Theory, and use some fairly sophisticated algorithmic strategies to better time potential entries and exits of individual stocks. Ryan and I speak daily about the multiple stratgies we manage, both in the investment portfolios and our CTA business. And of course, as we are both professional market technicans, we employ technical analysis in an attempt to better time our buys and sells.

Now for the lessons. If you are aspiring to manage other people’s wealth, here are a few takeaways that you will most certainly come across, especially with clients who may not know you well. These lessons aren’t examples of failures, in fact just the opposite. They are useful examples of situations you will learn from, just as I have.

Managing my own money is easy. I’m 37 years old and have a high appetite for risk, and have grown accustom to account drawdowns and rough stretches. While never fun, they are and always will be a part of process when investing in high growth companies the way I do. I’ve doubled investment accounts in under a year. I did so last year, and then some. This year is a different story, I am just positive on the year and YTD my investment accounts are lagging the market indexes. Over the past 5 years, my long term accounts are about 55% ahead of the S&P Index. I’m confident in the companies I own, and I understand there will be periods where my stocks will drastically outperform, and drastically underperform. This is completely normal.

Managing client accounts gets much more involved. In effect, what I have learned is you are managing client expectations, fears, greed, and everything in between. Everyone who comes to the market has different goals. For some, making 5% a year is great and slow and steady incremental gains are more important than trying to outperform while sitting through more severe drawdowns. That is perfectly fine and we have strategies to do this. But, before taking on any client, it is of paramount importance to help them understand their true risk tolerance. It is not enough to group them into risk averse, or risk seeking. Risk tolerance questionaires in my experience aren’t greatly beneficial. They can’t know how they will feel during inevitable drawdowns until they live them, and your job is an advisor is to assure them that this time is in fact completely normal and par for the course.

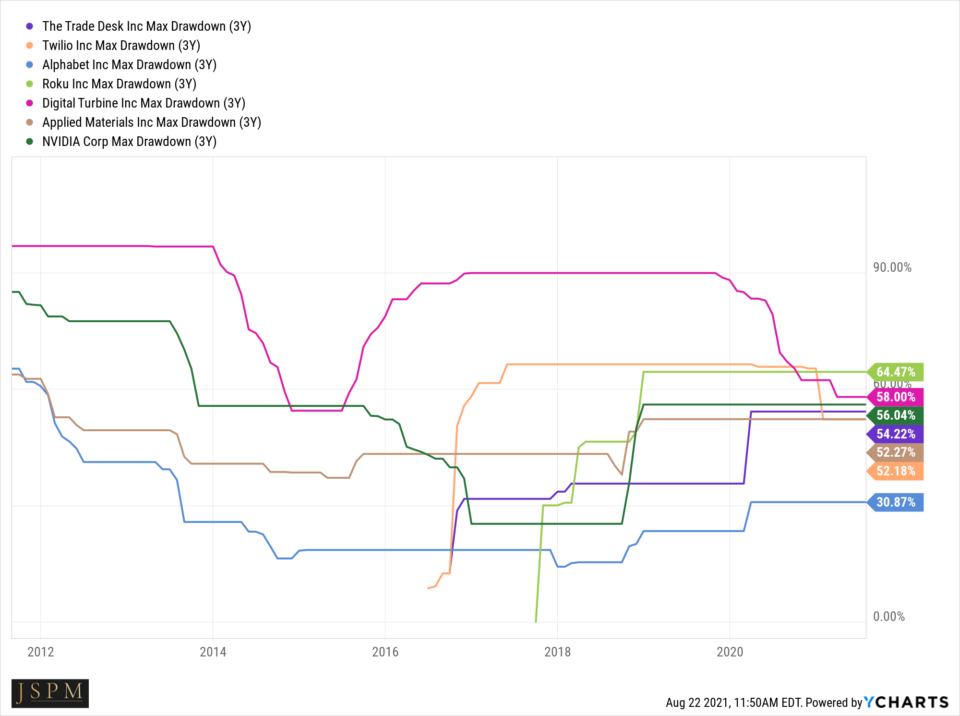

To illustrate the normality of growth investing, here are average drawdowns of some of my personal core holdings in my long term investment portfolio:

Growth investing (not trading), comes with 50-60% pullbacks and sometimes more. I run the JSPM-Omaha Growth Strategy, and while I never let a position go against clients to the depth you see above, understand that pullbacks of that severity are normal for growth stocks. Sometimes it can mean a company is losing its investable moat, or competion is catching up. Many times however, it’s just the nature of the game. One tenant of growth investing is that there is no free lunch. Meaning that outside returns without fail, come with outsized volatility and pullbacks. Clients who tell me to invest their money in the same manner as I do my own, come to understand that periods of underperformance happen. There are periods of bad, and then there are periods of good, and then really good. And the really good is often much better than the bad. Your job (my job) as an advisor is to educate clients who have a longer time horizon, and an appropriate risk tolerance that there is nothing new to any of this. It’s a cycle of give and take, and on the way to making a lot of money you will spend some time “losing” a lot of money.

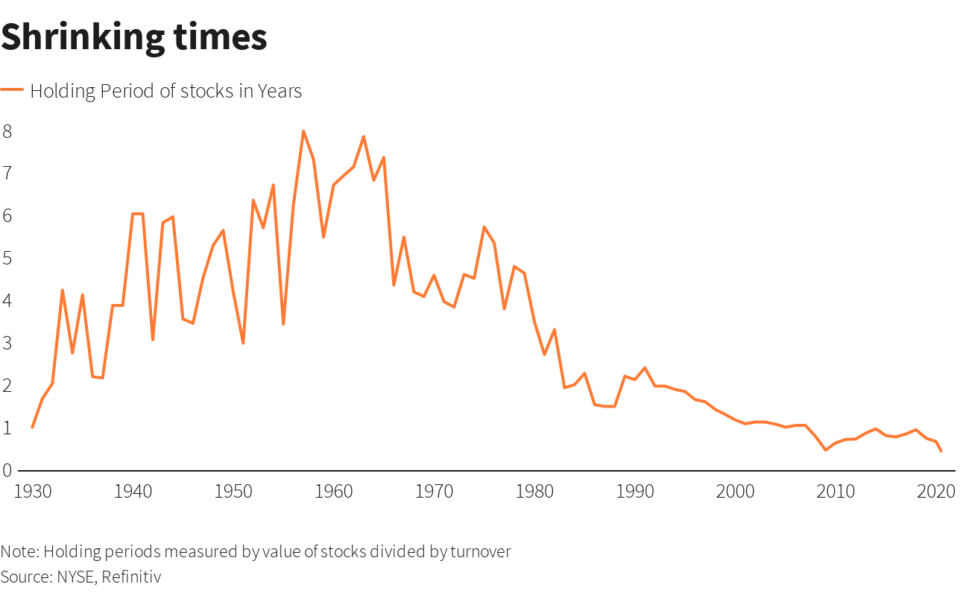

One of the most important questions to ask yourself and your clients is are you investing or are you trading? Investing is dying. Trading is all the rage. A true investor buys shares of good businesses, follows the companies quarterly, and doesn’t care about the stock price. A true investor would be fine with buying shares of a business should the market close for 5 or more years. A true investor doesn’t fret over day to day, week to week, or even year to year price action. Now that commissions are nearly free, and brokerage apps are on the main screen of every smart phone, investing is becoming a lost practice. Outside of dollar cost averaging into index funds via a 401k plan or the like, investing in individual businesses is seemingly becoming rare. Perhaps not so seemingly…

The above chart from NYSE, Refinitiv shows the average holding period for indivdual stocks has been on a steep decline since the mid 1970s. While I don’t agree with buying and holding forever, more trading has proven time and time again to have a deleterious affect on long term performance. Finding the balance between investing and trading can be tricky, and will be one of the obstacles advisors will face in the years to come.

Now for the surefire way to lose long term, first from the advisor perspective. I’ve come to realize that turning down clients is often in my best interest. New advisors may find this absurd. A year and a half ago when I began, I would have said the same. Today, I am getting much better at vetting clients out before starting a relationship with them. And while this may sound a bit salty, I likely don’t want your business if you are a nervous wreck, someone who watches the market day to day, or someone who doesn’t believe in our process. Saying “you aren’t right for us” is an advantage I have now, and one in which I will not hesitate to use going forward. New advisors will learn, probably quickly that there are some people who cannot be helped and would be best served in a target date fund or market index. If you let them, their interpretations of your process will only hold you back from the growth you know is coming. It’s best to part ways, and of course do so taking the high road.

Losing long term in the market is a difficult thing to do. If you are a self directed investor, being active isn’t the answer. Don’t believe me?

Best Investors Are Dead: Fidelity Study

Fidelity noted an internal performance review on accounts to determine which type of investors received the best returns between 2003 and 2013. The customer account audit revealed that the best investors are dead or inactive.

The inactive investors were people who switched jobs and “forgot” about an old 401(k).

They left their current options in place, and the dead investors had their assets frozen while the estate was being sorted through.

It turns out that being alive and active in the market seems to underperform your dead counterparts. Remember that the next time you reach for your investing app.

JSPM is growing. We have a lot of big plans, and will take the right investors along for the ride. We are leaving those not right for us behind. Taking them with us is a surefire way to lose in the long term.

Trent J. Smalley, CMT (Portfolio Manager JSPM LLC)