Recently I’ve received a few questions as to how I go about building a portfolio for either myself or a client. I thought it might be “fun” to put together a post that details out my process from top to bottom. What follows is an inside look at how I personally go about selecting securities that go into the JSPM-Omaha Growth Strategy.

Portfolio management is perhaps unique to some other businesses in that there is no one size fits all solution. In professional money management, we have to first and foremost take into account the client’s personal goals and risk tolerance. Clients that demonstrate a need for growth as well as having the appropriate tolerance for risk are suited for a portfolio that follows.

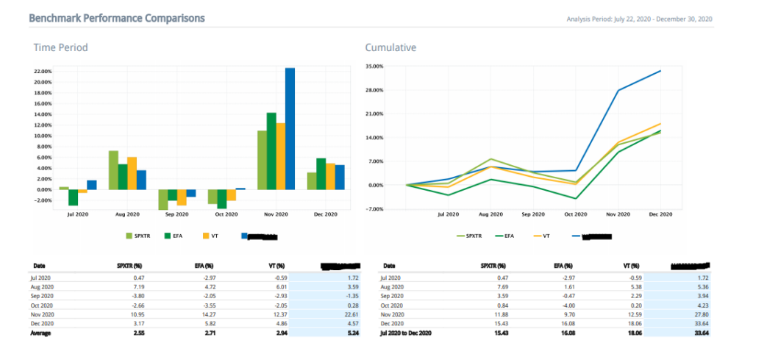

JSPM Omaha Growth Strategy End Of 2020 Performance

In the majority of my portfolios (both client accounts and my own) I will own a backbone of 10-14 stocks that I follow extremely closely. These are companies that I know inside and out from a fundamental perspective. In these names in particular I am armed with knowledge of their inner workings via institutional research reports and an understanding of their potential moats along with their TAM (total addressable markets). They have demonstrated that they are disruptors in their individual industry segments and have massive growth opportunities should they execute correctly. Some examples without naming individual names (I can’t do ALL the work for you), include areas like streaming content, alternative energy, cloud software, and mobile payments.

The above stocks won’t change frequently unless the story behind them changes, the industry thematic shifts, or they are acquired. These names are meant to be bought and held and if I do my job correctly (and they do theirs), many of these will be 2-5 year holds or longer provided the market environment doesn’t derail them. They will be adjusted several times a year to keep proper position sizing in line, but won’t be sold unless they give a reason to. If one of these stocks trades from $20 per share to $200 per share and back to $150 it makes me almost no difference. The nature of growth stocks as I have gone over time and time again, is that they go up fast and often fall even faster. The falling part gets uncomfortable but true wealth is built by buying and holding best of breed companies. It is not built by getting cute with regard to their hourly price action.

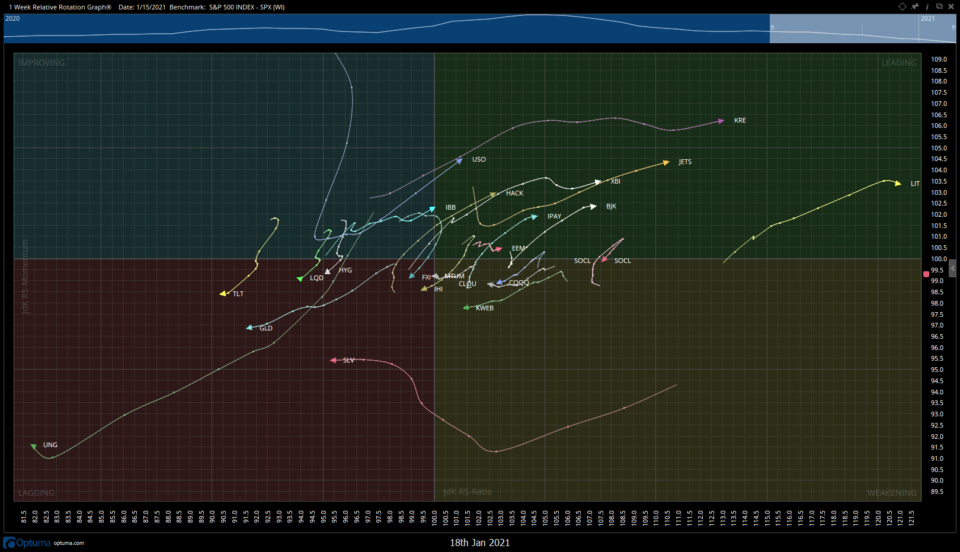

In addition to these 10-14 companies that are mainstays in the portfolio will be another 4-5 stocks that I see being acquired by institutions. These often come from relative strength scans. In other words, they don’t have to be companies that I know well, they just have to have strong recent price action supported by institutional volume. Across the equity landscape, individual sectors or industry groups come in and out of popularity. Most recently names in the oil space, leisure space, and banks / airlines have seen extreme relative strength. Why? The market as a whole is a forward looking mechanism, and as I type the market is currently looking ahead to the reopening of the U.S. and global economies. As more people receive the COVID vaccine, and people begin to return to a semi normal existence, people will return to flying, travelling, and resuming leisurely activities. Stocks in these areas often will have fundamentals ranging from mediocre to poor, but some have been beaten down to the point where the market foresees them to be of value. We don’t argue with strong price action here, and while they might not be long term holds they can serve a purpose in that they give us exposure to the current hot areas of the market. For these names I often consult RRGs (Relative Rotation Graphs) developed by my friend Julius de Kempenaer. These charts give a birds eye view of rotation in and out of different areas of the market as seen below:

To round out the portfolio, I often include 2-3 additional stocks which are of the more speculative variety. Here I pay no attention to fundamentals, and draw from several other techniques I’ve developed over the years. Stocks that may be included here may come from the highly volatile biotechnology sector, be a recently issued IPO, have high short interest, or be a stock that has had repeated “unusual option activity.” These stocks are only bought using a strict technical approach, and are positioned sized smaller than any of the prior stocks mentioned. They also are often not held very long as they are added with strict stop losses. Every so often one of these more speculative names stays in the portfolio longer than expected and works their way into a longer term holding. Price action dictates this, nothing more. They are owned in an effort to “juice” the portfolio. If they don’t serve their purpose, they are cut for small losses and I move on.

This blend of a fundamental, research driven approach backed by proper position sizing and using technical analysis to help time entries has proven time and time again to lead to success in both my own as well as client portfolios. The stocks held in the JSPM-Omaha Strategy are names in which I own myself, and believe to be the best that the market has to offer. I’m always revising my process and on the lookout for new companies and opportunities from which to prosper. In a growth strategy, I don’t concern myself with diversification (unless it’s a natural biproduct of the owned names), and don’t spread myself too thin across too many stocks. Core names are generally weighted between 5-8% while the tertiary and speculative names are often weighted between 2-4%. Owning too many stocks makes outperforming more difficult so I try and avoid this. Over the past 6 months this strategy has owned between 18-25 stocks at any one time. This is what works for me personally, but might not be right for everyone.

As of the close on Friday, the JSPM-Omaha Growth strategy has returned just over 7% YTD. (Past performance is not an indication of future results). If you are interested and think you might be appropriate for this style of investing, we are accepting new clients. Leave us a note at one of our sites below.

I hope you all had a nice long weekend and a great Martin Luther King Day.

Take care.

Trent J Smalley, CMT, JSPM LLC Portfolio Manager