On this day 30 years ago, the stock market experienced one of the worst crashes in its existence. On “Black Monday” the market fell over 508 points on heavy volume. Being about 4 years old at that time, it wasn’t something I was studying yet, but strangely enough I do feel like I remember my parents talking about it one morning after they poured me my cereal.

All these years later, it is something I have studied extensively. The question I find most people wondering is, could it happen again? Are we about to crash?

My answer: No, we are not about to crash. Not today, not next week, probably not next year or the year after that. “Crashes” are extremely unique anomalies. And the definition of “crash” isn’t wholly accepted or understood. Technological changes to market structure and mechanics along with new regulatory rules prevent a single day crash from happening nowadays.

Further, crashes are not single day events. They are processes, and they never happen on pessimism. There is plenty of pessimism to go around.

Dave Collum, who is a PhD in Organic Chemistry at Cornell, according to his profile is obviously not optimistic. I see this kind of attitude towards our markets much more often than I see any sort of euphoria. Sorry to make an example out of you, Dave. One of my favorite quotes that always holds true:

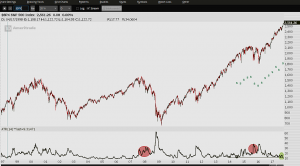

For each and every market top, there are a handful of “features” if you will that are present. Elevated market speed, high correlation among stocks, inverted yield curve, and some others I won’t take the time to go into at the moment. But I will share a simple chart with you that I think does a good job of illustrating one of the usual tells of market tops:

Now, if you would excuse me I am off to watch the crash. 😉

Great article in the Times today on Black Monday: Stock Market Panic Could Happen Again