Over the weekend a friend of mine asked me the following, “If you were to buy 5 stocks right here for your kids which ones would they be assuming you allocate $1000 to each stock?”

I love this type of question as it shows interest on behalf of parents who want to teach their youngsters about the power of the stock market, and making their money work for them. Inversely, I hate this kind of question because it is difficult. My analytical nature kicks into high gear and I want to start explaining Sharpe Ratios, Elliott Wave Theory, and intermarket analysis. No child deserves that sort of torture. No child wants to know about asset allocation and portfolio construction. We want to make this learning experience fun for them, so we will refrain from the intricacies that bore most to death. Also, we of course want these stocks to do well, and hopefully outperform the S&P 500 benchmark index.

The following are 5 stocks that I would recommend buying and holding for your kids, along with some basic information you can discuss with them, hopefully getting them interested. Each picture links to the appropriate company’s website so they can learn more about them.

First Solar is an alternative energy company which sells solar modules that turn sunlight into electricity. A fairly young company, established in 1999 is my favorite in the Solar Energy space. It is a higher “beta” stock, meaning that its price swings will be more erratic than a slower stock like General Electric. This will serve to keep things interesting. I am a big believer in solar energy being a part of our future and First Solar is in position to continue to be the front runner in the space.

A basic chart of First Solar shows one reason I am heavily invested in the company myself. We can call it “Blue Skies Above.” You can see clearly that the stock once traded between $120-$170. A sharp sell off in 2012 brought it back down to Earth and a better buy for interested investors. Think of it as your favorite handbag being on sale. And if you take good care of it, it may actually be worth more than what you bought it for in the future.

2. Under Armour UAA

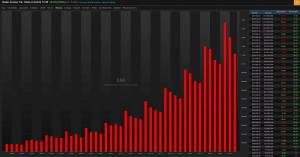

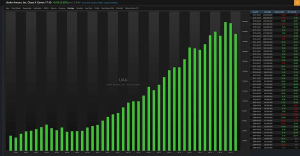

Under Armor is a brand everyone is familiar with, and will continue to be. The revenue and earnings for the company are in uptrends and the stock has fallen to levels where I would feel comfortable starting a position. The below charts show the uptrends of the revenue, earnings and shows that the stock has a lot of making up to do to return to previous highs. I think in time, it is in a position to do so.

3. Cameco Corporation CCJ

Perhaps the most speculative stock from this list is Cameco Corp. This name is a lesson in stock picking from a pure technical analysis standpoint. Why? Because the fundamentals of the company aren’t good. You’ll have trouble finding a P/E Ratio for the stock because it doesn’t have one. It is spending more than it is making. A fundamental analyst would run from this company. A market technician would recognize the upside potential from an auction theory standpoint. Markets are simply places which connect buyers and sellers, and this stock has been sold by nearly everyone. Let’s take a look at a chart with a couple of basic points of interest…

Very simply, you can see that the overall price trend is down. From left to right price has been in a steady downtrend for some time. On the left side of the chart you can see that there was some erratic price movement where buyers and sellers were battling it out, trying to determine an agreed upon fair price of the stock. Since then, price has steadily but quietly drifted lower. Recently, it has begun consolidating, and price seems to be agreed upon by both the buyers and sellers. A big base is forming in the stock which should serve to prop up price, meaning most of the selling pressure has taken place, and reward to risk favors the upside. At the bottom of the chart I included a well known technical study market technicians use called the RSI, or Relative Strength Index. RSI is strengthening which means that the magnitude of recent price moves have been faster to the upside. This can serve to alert us that buyers may be taking notice of this beaten down stock once again. We want to get in while it is still on sale.

You may have noticed that for this stock I haven’t even mentioned what the company does. That is actually common for studying markets from a technical standpoint. I trade stocks all the time that I am not even sure what they do or if they make more money than they spend. I am simply using the auction process and my knowledge of how buyers and sellers react to price changes to participate in eventual upside. It’s actually an exciting company however, producing and selling uranium worldwide. It is part of an industry group we call the Nuclear Sector.

4. Intrepid Potash IPI

IPI is a company that produces and sells potassium products which serve as chemicals for the agriculture, industrial, and animal feed markets. Not too sexy right? Right. But, for a very specific technical reason I am heavily invested in this little company out of Denver, Colorado. I think it triples from here if you give it enough time. It might not happen this year, or next year but it will triple.

Here is a post I did on IPI some time ago so you can see why I like it:

https://omahacharts.com/single-post/2017/07/19/Dont-Sleep-On-Intrepid-Potash

5. Apple AAPL

It is difficult not to include Apple in a list of stocks to buy and hold for kids (or anyone). I will use Apple to teach a couple of lessons here. First, it is just hard to bet against a giant with over 285 billion in cash on hand. If the stock price falls too far, they will likely purchase shares (share buyback) to prop up price. Second, it is one of the world’s most recognized brands and there is no sign of that changing. It’s a behemoth that is difficult to compete with no matter how hard the Samsungs of the world try. Next, Apple pays a 1.5% dividend to it’s shareholders. This means that they pay you to own their stock which if things go well you are capturing the payable dividend as well as capital appreciation as the share price increases in value.

I would take a tactical approach when looking to buy shares of Apple. The other 4 stocks on this list you may have noticed have fallen to lower levels where we are looking to buy them on the cheap. Apple is different, it’s been in a steady uptrend as we can see from the chart below.

There are two lines on the above chart, one that curves along under the price candles and one that is a straight line connecting the lows. The first is what we call the 200 day moving average. This is a level that many market participants watch. The second is a trend line that connects the higher lows, signifying that the stock is in a defined uptrend. In starting an Apple position for the long term, I would wait to buy until the price falls back towards either the trend line or the 200 day moving average. There is no use paying top dollar for it if we can help it. I think we will get a chance to buy it cheaper, and that is always my preference.

Hopefully the above list serves as a good basket of stocks to gain the interest of a new investor. I recommend looking at prices of the stocks you own at the end of each week. You can see how price changes from one week to the next and watch overall trends. Some weeks your holdings will have increased in value, and others you will experience what it is like to see losses. That is perfectly normal. The emotions investors feel can’t be taught out of a book, but only learned via real life application. There is huge benefit to investing from a young age. A million articles have been written about the power of compound interest so I won’t cover that here. I can’t guarantee that all (or any) of the stocks from this list go up, or how fast. What I can guarantee is that they will serve as learning vehicles, as all of them are quite exciting. That is why I own every one of them myself.

Any questions, always feel free to email me at [email protected]

Happy Investing!

OC